Soda Tax IS Necessary to Reduce Health Concerns – Your Thoughts?

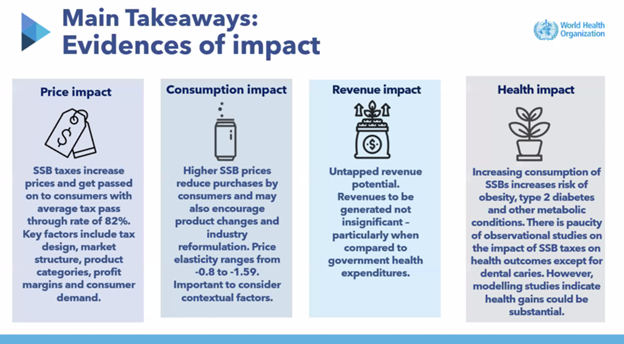

On December 13, 2022, the World Health Organization (WHO), launched a tax manual for sugar-sweetened beverages (SSBs) to encourage nations worldwide to consider levying the SSBs tax to curb the consumption of these drinks. Dr. Rudiger Krech, the WHO’s Director of Health Promotion, indicated that SSBs had little nutritional value while contributing to “tooth decay, weight gain and obesity, metabolic conditions and other diet-related non-communicable diseases” such that taxing SSBs can be a consumption deterrent. The manual details positive impact of levying SSBs tax in four areas – Price, Consumption, Revenue and Health – as shown below:

Discussion Questions:

- Watch this 4min “Soda Sizes” clip from Parks & Recreation series. Discuss why the consumption of SSBs is considered a negative externality from the government perspective.

- Browse the WHO’s SSBs Tax Manual and

- discuss key takeaways about the SSBs Tax on the four identified impact areas.

- explain if government intervention is necessary to help resolve market failures in the market for SSBs.

- Read the “Consumption Impact” column of the WHO image above, and use a demand-supply graph to explain the sentence, “Price elasticity ranges from -0.8 to -1.59”, with respect to the slope of the SSBs demand curve – elastic, inelastic or unit elastic?

- Read the explanations provided to Figures 3 and 4 of the journal article, “Should We Tax Soda? An Overview of Theory and Evidence” and discuss the impact of the SSBs tax burden on the consumers and the producers.

- Read the section on “How are Soda Taxes Funding Health?” and to understand how the soda tax revenue is being used by U.S. cities in helping their community. Discuss if the soda tax should be expanded to all fifty states?

- Self-reflection: Would you increase, decrease, or have no change in your own soda consumption after learning about Soda Tax? Do explain.

Sources| WHO: https://www.who.int/publications/i/item/9789240056299; Health Policy Watch: https://healthpolicy-watch.news/taxing-sugary-drinks-is-a-win-for-health-and-government-revenue/; YouTube: https://www.youtube.com/watch?v=lYkwcRdFnbM; Salud-America: https://salud-america.org/soda-tax-revenue-for-emergency-grocery-vouchers-coronavirus-pandemic/; AEA Web: https://www.aeaweb.org/articles?id=10.1257/jep.33.3.202 – Allcott, Hunt, Benjamin B. Lockwood, and Dmitry Taubinsky. 2019. “Should We Tax Sugar-Sweetened Beverages? An Overview of Theory and Evidence.” Journal of Economic Perspectives, 33 (3): 202-27. DOI: 10.1257/jep.33.3.202; Unsplash: https://unsplash.com/photos/9UUfyLBKojw