Gas Tax for New Zealand Farmers to Reduce Greenhouse Emissions

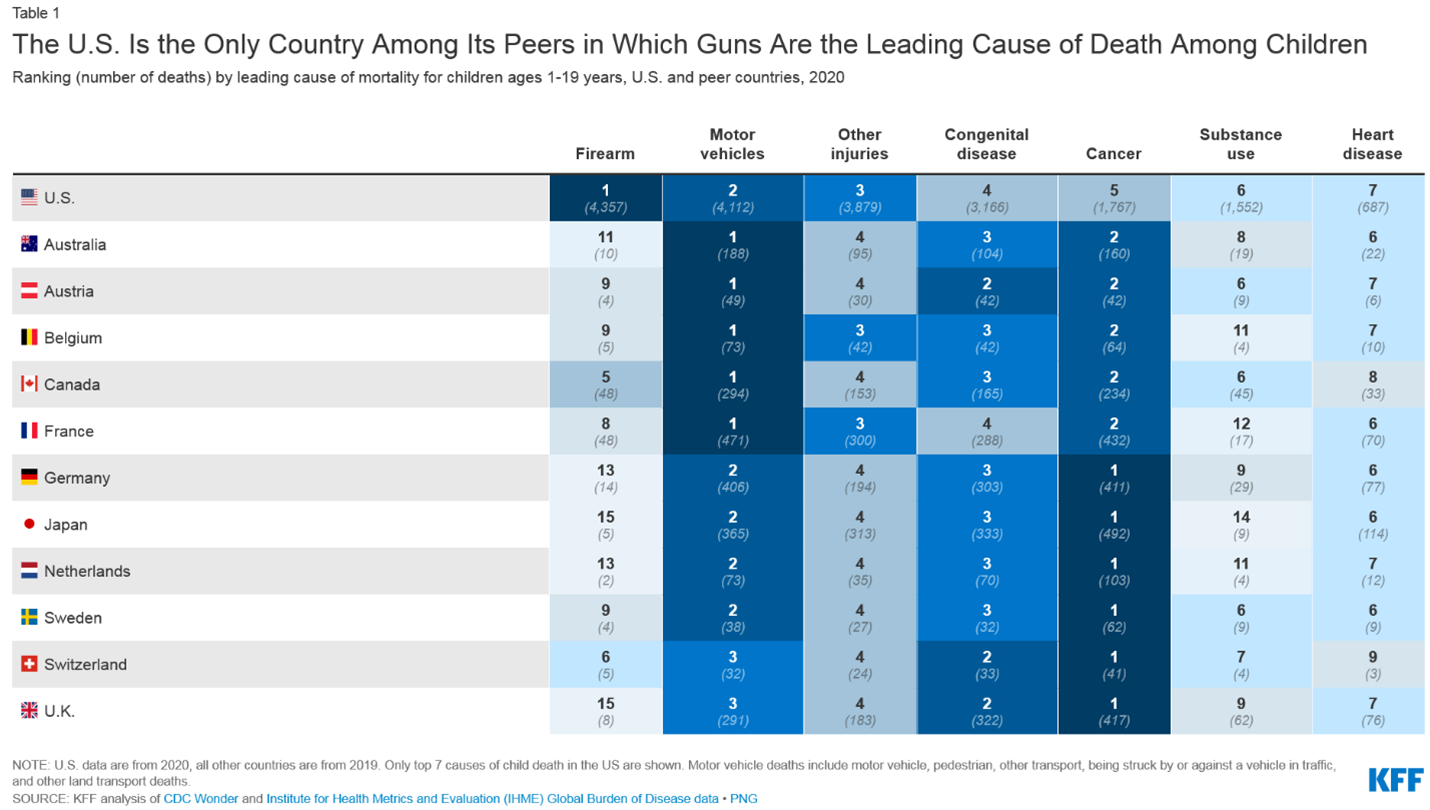

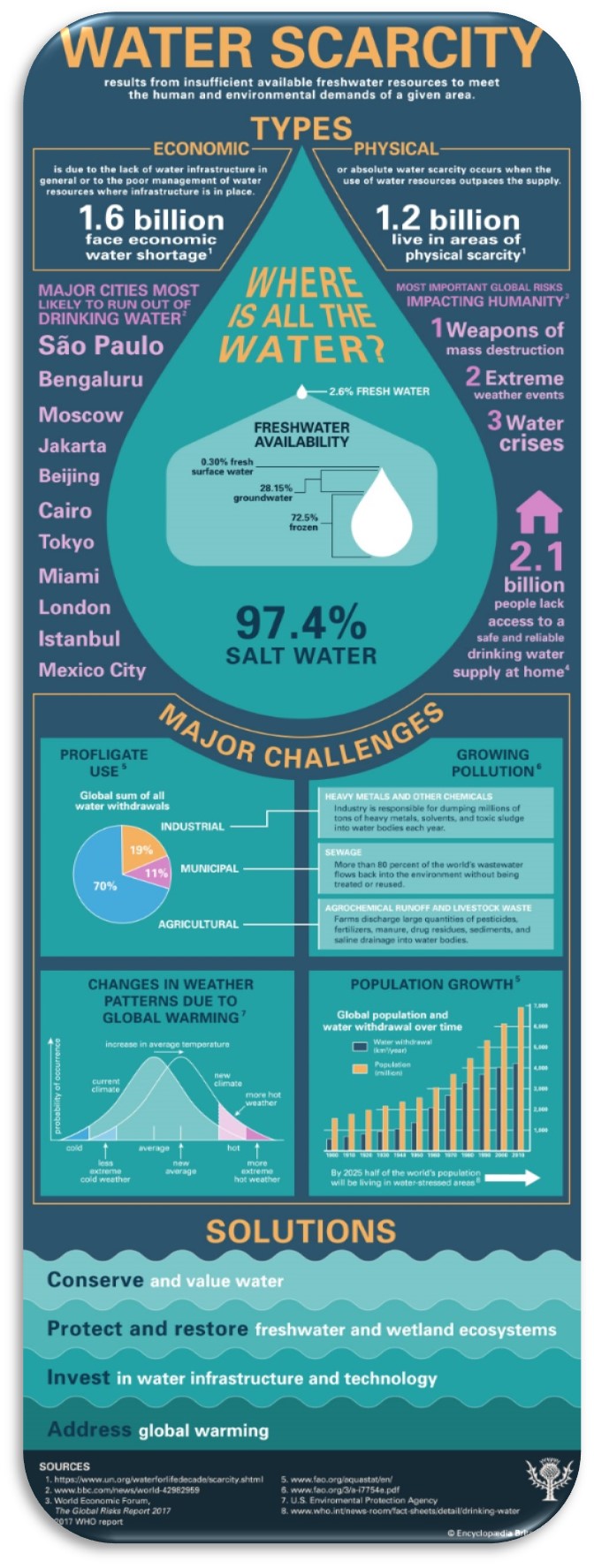

In 2019, New Zealand was the ranked 17th in emitting 6.8 metric tons per capita of carbon dioxide gases amongst OECD members. Two years later, the Ministry for the Environment released a report – New Zealand Greenhouse Gas Inventory 1990-2019 – identifying the agricultural and energy sectors to be the largest contributors to the country’s gross greenhouse gas emissions at 48.1% and 41.6% respectively. It pinpointed that over the twenty-year period, the gross emissions (see image) were coming from methane released by dairy cattle digestive systems (at 18.7%) and carbon dioxide from road transport (at 17.8%):

On October 11th, 2022, the government announced a climate friendly agriculture proposal to address the greenhouse emissions that includes a farm-level, split-gas levy for pricing agricultural emissions, two options for pricing synthetic nitrogen fertilizer emissions, and an interim processor-level levy as a transitional step if the farm-level levy cannot be implemented by 2025. Farmers will start paying levies on their self-calculated emissions from 2025, depending on their farm area, livestock numbers, livestock production and nitrogen fertilizer use.

Prime Minister Jacinda Ardern encouraged farmers to be the first in the world to participate in a system of pricing agricultural emissions to produce climate-friendly agricultural products that will help to increase exports. She also added, “The proposal aims to give New Zealand farmers control over their farming system, providing the ability to reduce costs through revenue raised from the system being recycled back to farmers, which will fund further research, tools and technology and incentives to reduce emissions.”

Discussion Questions:

- Based on the emission tax concept, draw and explain how the gas tax for the farmers will help in reducing greenhouse emissions from the agricultural sector.

- Which externality does the greenhouse emissions signify – positive externality or negative externality? Do explain.

- Based on the “Polluter Pays Principle”, do you think it is fair for the farmers alone to pay the levies? What about intermediate firms like meat manufacturers, packers, fertilizer producers? Do explain.

- Self-reflection: As a consumer of agricultural products,

- will you support the gas tax on the farmers?

- If the farmers’ passes on the gas tax expenses to the consumers in terms of higher prices of agricultural products, will you still support the gas tax?

- Describe two other ways to address greenhouse gas emissions. Do explain.

Sources| The World Bank: CO2 emissions (metric tons per capita) – OECD members, New Zealand; RNZ: NZ greenhouse gas emissions: Agriculture, energy sectors biggest contributors in 2019; Newshub: Climate change: Farmers to pay for emissions from 2025 under proposed scheme, Jacinda Ardern says they’ll benefit from being world-leading; Federal Reserve Bank of St. Louis: Externalities – The Economic Lowdown Video Series; Environmental Economics: ECON 101: An emissions tax; Academy 4SC: Polluter Pays Principle: Where There’s Smoke; Unsplash: Picture of cows